Lithium Americas is pleased to provide an update on the transaction announced , whereby Ganfeng Lithium Co. Ltd. has agreed to subscribe, through a wholly-owned subsidiary, for newly issued shares of Minera Exar S.A. , the holding company for the Caucharí-Olaroz lithium brine project (the “Project” or “Caucharí-Olaroz) for cash consideration of US$160 million.

Transaction Update

Since announcement of the Project Investment, Lithium Americas and Ganfeng Lithium have been working diligently to satisfy the necessary conditions to closing and the Company is pleased to provide the following updates:

- Ganfeng Lithium Regulatory Approvals – the Company has been advised by Ganfeng Lithium that it has received all required regulatory approvals for closing the Project Investment.

- Credit Agreement Consent – BCP Innovation Pte Ltd. (“Bangchak”), as one of the Company’s senior lenders under its 2017 credit agreement, have provided their consent to the Project Investment. In consideration for providing its consent, in the event the Company approves an expansion of the stated production capacity of the Project from its current targeted production of 25,000 tonnes per annum (“tpa”) to 40,000 tpa, the Company will be obligated to provide incremental off-take rights in favour of Bangchak to acquire up to an additional 3,500 tpa of lithium carbonate at market prices.

- Shareholder Approval – shareholders of the Company and Ganfeng Lithium will be asked to approve the Project Investment at each company’s shareholder meetings, scheduled to be held on June 26 (Lithium Americas) and June 11 (Ganfeng Lithium).

In addition to shareholder approval, the Project Investment remains subject to satisfaction of a number of conditions precedent, including execution of an amended and restated shareholders agreement for Minera Exar, and is expected to close by early Q3 2019.

Upon closing of the Project Investment, Ganfeng Lithium will acquire approximately 141 million newly issued shares in Minera Exar, which will increase its interest in Caucharí-Olaroz from 37.5% to 50%, with Lithium Americas holding the remaining 50% interest (each subject to the rights of JEMSE (the Government of Jujuy) to acquire an approximate 8.5% interest in Minera Exar).

Annual General Meeting

Lithium Americas annual general meeting of shareholders is scheduled to be held at 1:00 p.m. (Pacific Time) on June 26, 2019 at the offices of Cassels Brock & Blackwell LLP, Suite 2200, 885 West Georgia Street, Vancouver, BC V6C 3E8 (the “Meeting”).

Management’s Information Circular for the Meeting has been filed on SEDAR at www.sedar.com, on EDGAR and is also available through the Company’s website www.lithiumamericas.com. The Circular contains additional information regarding the Project Investment, as well as information relating to annual business to be conducted at the Meeting, such as appointment of the Company’s director nominees. All shareholders are encouraged to vote at the Meeting. Details on how to vote are contained in the Information Circular.

Shareholder Information and Questions

Lithium Americas shareholders who have questions about the Meeting, the Project Investment or need assistance with voting can contact our proxy solicitation agent, Laurel Hill Advisory Group:

Laurel Hill Advisory Group

North American Toll Free: 1 877 452 7184

Collect Calls Outside North America: 1 416 304 0211

Email: assistance@laurelhill.com

Bangchak Consent

As described above, Bangchak has provided its consent to the Project Investment. In consideration for providing the Bangchak consent, the Company has agreed that if an expansion of the stated production capacity of the Project from 25,000 tpa to 40,000 tpa is approved, the Company will be obligated to provide incremental off-take rights in favour of Bangchak to acquire up to an additional 3,500 tpa of lithium carbonate, up at an aggregate maximum of 6,000 tpa of lithium carbonate (at a 40,000 tpa project capacity) at market prices. The consent is conditional upon entry into an amended off-take agreement with Bangchak concurrently with the closing of the Project Investment.

Ganfeng Lithium, as the Company’s other senior lender, has already consented to the Project Investment. In addition, the consent includes a commitment from Bangchak to provide up to US$50 million of additional debt financing on substantially the same terms as the Company’s existing senior debt facility, however, with the proceeds of such financing available for a broader purpose. Should the Company elect to pursue this additional debt financing in the future, such financing will be subject to negotiation of definitive documentation and consent of the Company’s other lender, Ganfeng Lithium, under its senior credit and subordinated loan agreements. There can be no assurances that the Company will be able to realize on such additional debt financing, including the terms and timing thereof.

Receipt of Bangchak’s consent to the Project Investment for the consideration described above constitutes a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”) because Bangchak and its affiliates are significant shareholders (approx. 15.8%) of Lithium Americas. Consequently, the Project Investment is subject to the formal valuation and minority approval requirements set forth in MI 61-101.

MI 61-101 provides that where an issuer borrows from a related party or sells, transfers or disposes of an asset to a related party, those transactions may be considered “related party transactions” for the purposes of MI 61-101. The potential transactions related to Bangchak’s consent, being a 3,500 tpa increase in off-take committed from the Company to Bangchak and an increased US$50 million loan commitment from Bangchak to the Company, do not attract, or are exempt from, the formal valuation or minority shareholder approval requirements of MI 61-101. In the case of increased borrowing, a formal valuation is not required as that transaction is not the type of related party transaction that requires a formal valuation. In the case of the increased loan commitment, it is expected that any potential increase would be made available on terms consistent with the Credit Agreement and that any such borrowings would be on reasonable commercial terms that are not less advantageous to Lithium Americas than if the loan were obtained from an arms’ length party.

In addition, the loan would have no equity component. As a result, any such credit increase from Bangchak would be exempt from the minority shareholder approval requirements on the basis of the exemption set out in Section 5.7(1)(f) of MI 61-101. In the case of any potential increase in lithium off-take to Bangchak, as the terms of the off-take provide for sales to be completed at market pricing at the time of any actual sale, it has been determined that any such off-take increase would not be subject to either the formal valuation or minority shareholder approval requirements of MI 61-101 on the basis of the exemptions in Sections 5.5(a) and 5.7(a) of MI 61-101, being that the fair market value of the consideration for or the transaction would not exceed 25% of Lithium America’s market capitalization (calculated in accordance with MI 61-101).

About Lithium Americas

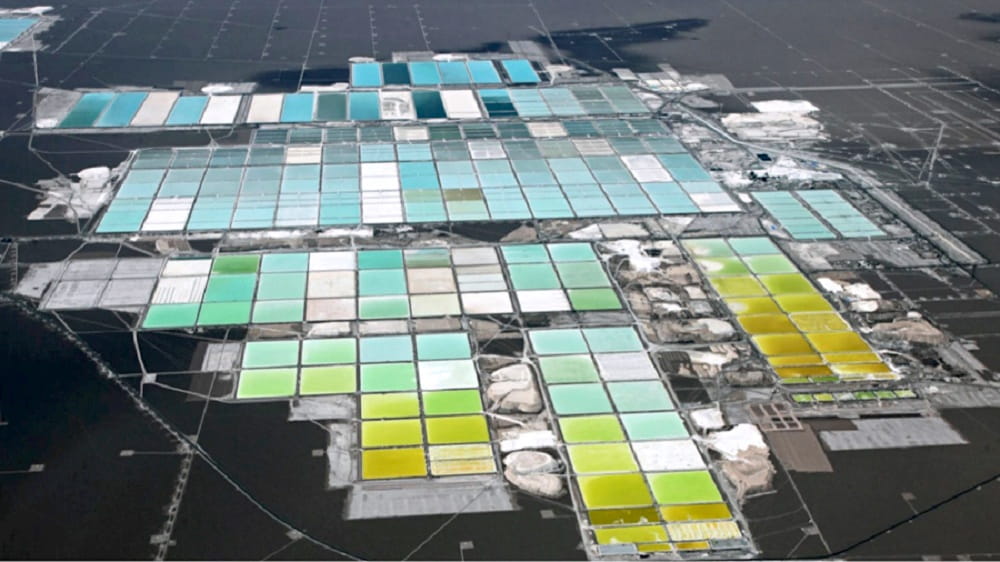

Lithium Americas owns a 62.5% interest in Caucharí-Olaroz along with its partner, Ganfeng Lithium. As a result of the Project Investment, Ganfeng Lithium will increase its interest in Caucharí-Olaroz from 37.5% to 50%, with Lithium Americas holding the remaining 50% interest. In addition, Lithium Americas owns 100% of the Thacker Pass lithium project located in Nevada, the largest known lithium deposit in the United States. The Company trades on both the Toronto Stock Exchange and on the New York Stock Exchange, under the ticker symbol “LAC”.